Giveaway 2024 (Concluded)

LUNO Malaysia has very kindly given us some goodies to give away again this 2024!

We’ll be giving out TEN Luno water flasks this time around and the details are as follows:

Answer the following: What do you like most about Luno & what would you like to see on Luno?

Platform: Comments on this article, Instagram and Facebook

T&C: New and existing Luno users (use code HFCCY)

We’ll select the 10 best answers and will be in touch.

We’ve got a new sign-up promo from Luno. New sign-ups with my code: HFCCY will now receive RM75 worth of BTC when you make a transaction of RM250 or more with the instant buy feature. It was RM50 for RM500 previously so it is a huge bump!

This is a full-on review of Luno Malaysia. If you’re here looking for a referral and promo code to use for your sign-up, you can use my code HFCCY, you will get RM75 worth of Bitcoin when you buy RM250 or more. That’s an instant 30% return on your investment. This is valid forever as of now so don’t worry. I will update this if and when it is no longer available. Sign up hERE.

Do remember to use my code HFCCY, you will get RM75 worth of Bitcoin when you buy RM250 or more.

ETH Staking is finally here!

If you do not understand ETH’s staking, which takes the form of PoS – proof of stake, you can find out more hERE. You can understand the basics here and of course, there are more technical ways to get your ETH to work for you out there ie. Liquid staking. Some exchanges even provide you with a pegged token once you’ve staked and you can then use said pegged tokens for other uses. But for Luno’s case, it is a straightforward proof of stake.

A keyword to understand:

ARP (Annual Rewards Percentage) – This is your net returns per annum, fees will have already been calculated and what you see is what you get on Luno.

For more information on staking and rewards on Luno, try this link hERE.

I will be clawing back and moving the ETH I have around the crypto-verse and hard wallets and moving them to Luno. Staking is a huge step for our local exchange. Why Luno? I’ve got the protection of our SC and personally, I know how hard it was for Luno to get staking set up on our shores.

I’ll also continue to share the staking returns monthly or bi-monthly here.

How to stake on Luno

- Go to your wallet then select STAKE

- Create an Ethereum Staking wallet

- Enter the amount of Ethereum you’d like to stake then select NEXT

- Confirm the amount of Ethereum to be staked and click STAKE NOW

- Earn Ethereum rewards every week.

If you’re new to Luno and have been waiting for staking to come to us, please feel free to sign up using my link hERE.

My code is HFCCY. You get RM75 when you purchase RM250 worth of crypto. More info on this below.

My Crypto Portfolio on Luno

My latest Luno portfolio, which makes up the bulk of my crypto assets will be updated here. Previous updates can be found at the end of this article.

Moving forward, I’ll be updating my crypto portfolio on a monthly/bi-monthly basis here.

October 2024 Update

October update 🚀

Gross investment: RM46,000 (moved RM30K ETH to Luno)

Market value: RM119,285

Capital gain: +159.32%

Previous profit: RM50,000 (approximately)

We’re way up after Trump’s big win in the US and A. I’ve taken a little profit and kept the cash in Luno. I’ll repurchase again if and when the prices drop. Sitting on about RM17K in cash right now.

ETH Staking APY was 2.6% in October. It is at a cool 3.9% right now in November. (so far)

If you’ve been missing out and think crypto’s future looks good, it may be time to go ahead and sign up with Luno. Don’t forget to use my referral code! Make sure to do your own due diligence though.

As always, volatility is almost synonymous with crypto. I’ve documented my returns all here in this page itself.

Luno has also upped its sign-up rewards. It is now RM75 for new registration and you only have to spend RM250 on an instant buy transaction when you use my code: HFCCY. That’s 30% guys!

We were at RM50 for RM500 previously. Please take advantage of this if you haven’t signed up.

You can find my previous portfolio updates at the bottom of the page.

My Take and Review on Luno Malaysia

Who Is Luno Malaysia?

If you’re into cryptocurrencies and you live in Malaysia, chances are you’ve heard of Luno Malaysia. They’re the largest cryptocurrency exchange in Malaysia.

As of May 2021, Luno Malaysia offers the following cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

Is Luno Safe? Is Luno Legit?

Safety-wise, Luno is the first regulated cryptocurrency exchange in Malaysia. And that’s saying something.

They’re regulated by SC so there’s really nothing for us to worry about fraud from Luno as an exchange.

A cyber attack however is something entirely different. Attacks and hacks on an exchange can happen and has happened in the past. But then again, there’s really nothing we can do about it.

As of now, if you’re a Malaysian and looking for a crypto exchange, I’d say Luno is your safest bet. I have the majority of my coins stored with Luno.

Moving your Crypto to Luno

I have recently moved all my coins – Bitcoin, Ethereum and Bitcoin Cash to Luno’s platform.

The process was surprisingly simple and easy. Bear in mind that this is my first time sending / receiving coins.

It took around an hour for all my cryptocurrencies to arrive as they require confirmations on the blockchain.

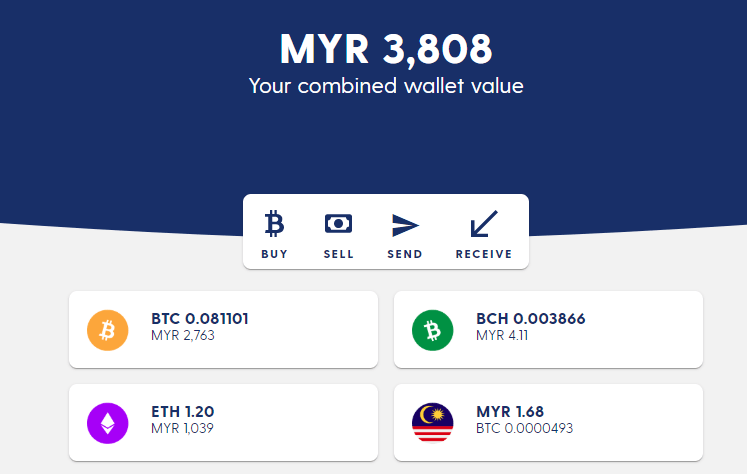

As of today, my total crypto portfolio stands at RM3,808. For a roughly 1.5 year period, my return is about 200%.

I’ll be using Luno as a wallet to stash all my cryptocurrencies from this point on as well as an exchange to buy/sell.

The user interface is spot on and the support I’ve received from them with my inquiries has been outstanding.

Luno’s Wallet

Keeping your hard-earned bitcoins and other cryptos on Luno Malaysia itself is something all users can do. I myself do that but as my holdings grow in size, I will be thinking of moving them to a standalone wallet, maybe even an offline one.

Luno’s wallet is what is known as a custodial wallet. This means that your private keys are stored by a third party, in this case – Luno. Placing your coins in a custodial wallet is similar to the principles of placing your cash in a bank. The money remains yours, but you do not fully control your money when it is in their hands.

Advantages

- Interest generating. Some exchanges/custodians are giving you money to store your coins with them. Think of your coins as being used as a sort of money market fund. Hoping to see this come to Luno in the near future.

- Convenience. You’re able to manage all your funds in one place and at any time.

- You won’t lose or forget your private key and access to your coins.

Disadvantages

- The custodian has control over your money.

- Your coins can be seized by a court decision.

- If the wallet gets hacked, you may lose your coins.

Before you cry foul and move all your coins to your own private wallet, Luno actually has three layers of security for their wallets and your coins. The first layer is the industry standard where an external custodian secures the keys. This is for practical reasons otherwise moving funds would take too long.

The second and third layer is where the security intensifies and where the bulk of the coins are stored. Luno actually practices what they term ”deep freeze storage”. Essentially, the private key is broken up and stored in different places around the world.

For the reasons above, you may want to have a percentage of your coins with Luno and another in your own private wallet. If you plan to just hold for a very long time, keeping it on your own wallet would make more sense. Just don’t forget your keys.

However, if and when Luno announces the interest bearing feature, I think a lot of bitcoin holders will see value in keeping their coins with Luno.

As for security on your own side, please, please set up 2-Factor Authentication for your accounts. Better safe than sorry especially if you’ve got a significant percentage in cryptocurrencies.

Luno Malaysia’s Fees – Post Order Only

First off, sending and receiving your cryptocurrencies. When you receive, Luno doesn’t charge a fee. When you send, you’re charged a fee.

When actually buying and selling on Luno’s exchange, to save on fees, forget instant buy/sell and instead, do a post order. Tick the ”post-only order” and you’ll see the difference in your fees.

Right at the bottom, tick that. You won’t instantly get your coins if you’re buying, instead, set a price close to the market price. Creating a post-only order ensures that you won’t have to pay a taker fee. An order will only be added to the order book if it does not match with a pre-existing order. If it does, it will be canceled.

Besides that, to get a full picture of other fees, you can visit Luno’s page on it hERE.

Why Bitcoin?

As always, prior research and due diligence on your part is required before making investments. For any asset class.

I’ve been monitoring cryptocurrencies, especially Bitcoin on and off for a few years now and I have my reasons for investing in it.

My first venture into cryptocurrency was back in December 2018. I invested USD 288 (or approximately RM1,256) back then.

Back in August 2020, my portfolio stood at RM3,808.

Cryptocurrency investment has been one of my biggest regrets. I regret not having put more money here. Of course, hindsight is always 20-20 but nonetheless, it is one of many regrets for me.

BITCOIN AS A STORE OF VALUE

Firstly, I see bitcoin as digital gold. As we transition to a digital economy, bitcoin will eventually challenge gold as a global store of value.

Like gold, bitcoin is limited in its supply. Bitcoin is limited to only 21 million. Forever. Not only is bitcoin scarce and durable like gold, but bitcoin also improves upon many of physical gold’s characteristics. Bitcoin is divisible, verifiable, portable, and transferable.

If bitcoin were to take just a 10% share of the physical gold market, we could see its value increase 5X to $1 trillion.

With the continuous printing of money, bitcoin has been viewed as an asset similar to gold in the modern world as a hedge against inflation. A good article on this can be read hERE.

BITCOIN’S POTENTIAL

My next reason for investing in bitcoin is its sheer potential upside. There are many theories and thoughts on bitcoin’s adoption as a currency. Or even as a global settlement network for banks as businesses.

We’ve already seen PayPal recently move in that direction. Payment systems like Square Inc have bought into bitcoin. The potential is there. Unlike gold, gold has already plateaued whereas bitcoin’s potential is still vast.

I’ll be looking closely at Bitcoin and Ethereum especially moving forward. Although volatile in nature, with bigger upside potential, I’ll prefer buying Bitcoin to Gold when it comes to hedging.

Luno Malaysia Best Referral Code (RM75)

As part of a collaboration with Luno Malaysia, we’ve come up with the perfect promotion for new users wanting to invest in Bitcoin.

Using the following referral code – HFCCY, you will get RM75 worth of Bitcoin when you buy RM250 or more. That’s an instant 30% return on your investment. Sign up hERE.

If you’ve been wanting to own some Bitcoins, now is really the time to start.

Unfortunately, this promo and referral code is for new users only. Also, make sure you use Luno’s instant buy (instead of a post-order) function to be eligible for this code.

After signing up, you enter the promo code as follows:

For mobile users, head to the Rewards tab at the bottom and enter the code: HFCCY

For desktop users, the Rewards tab is on the top right, enter the promo code: HFCCY

In short, to be eligible for the RM75 promo and referral code, you have to:

1. Register as a new Luno Malaysia customer;

2. Enter my Luno promo code: HFCCY (BEFORE you make a deposit into your Luno account);

3. Make a purchase of at least RM250; and

4. Make sure the purchase is through Luno’s Instant Buy feature.

The full promo rules can be accessed hERE.

Please go through them carefully to meet the criteria for that RM75.

End.

I’ll be moving more of my cash into Luno and increasing the size of my crypto portfolio in the future when the price is right. At least that’s the plan right now.

Just as how I prefer to purchase a mother share over warrants and how I prefer to buy shares of the main company over its subsidiaries, I’ll be focusing more on Bitcoins compared to other coins.

As always, Facebook, Instagram, and now ! Follow, keep up to date.

Previous Updates

July 2024 Update

July update 🚀

Gross investment: RM46,000 (moved RM30K ETH to Luno)

Market value: RM98,072

Capital gain: +113.20%

Previous profit: RM50,000 (approximately)

These figures were taken a few days prior. BTC has since gone up but I’ll leave that for August’s update.

Staking of ETH has increased slightly to slightly more than 3%. Still holding both BTC and ETH for now. Got some USDT on Telegram for their 50% APY (for two weeks only).

The portfolio is down by 10+% since June. It may be a good time to start looking at crypto again if you’ve been wanting to jump in. Don’t forget to use my referral code! Make sure to do your own due diligence though.

June 2024 Update

June update 🚀

Gross investment: RM46,000 (moved RM30K ETH to Luno)

Market value: RM106,349

Capital gain: +131.19%

Previous profit: RM50,000 (approximately)

The portfolio is down by 20+% since May. It may be a good time to start looking at crypto again if you’ve been wanting to jump in. Don’t forget to use the

May 2024 Update

May update 🚀

Gross investment: RM45,441 (moved RM30K ETH to Luno)

Market value: RM125,792

Capital gain: +176.82%

Previous profit: RM50,000 (approximately)

Just as the value dropped to RM112K last month, it has now gone up again back above RM125K. Mostly thanks to ETH.

Staking of my ETH on Luno has been all right so far. We got about 2.5% in March and 2.9% in April. And so far sitting at 2.6% for May.

March & April 2024 Update

March update 🚀

Gross investment: RM44,441 (moved RM30K ETH to Luno)

Market value: RM112,997

Capital gain: +154.26%

Previous profit: RM50,000 (approximately)

Crypto being as volatile as it has always been, we saw the market value of my coins reach around RM120K+ and dropped back down to RM112K now. As expected, the highest point was just before the halving where most people took profit. Moving forward, I will continue to add more to BTC every month.

Staking of my ETH on Luno has been all right so far. We got about 2.5% in March and 3.1% in April. Will continue to monitor.

February 2024 Update

February update 🚀

Gross investment: RM44,441 (moved RM30K ETH to Luno)

Market value: RM107,382

Capital gain: +141.56%

Previous profit: RM50,000 (approximately)

As mentioned in November, I sold about half of my BTC holdings.

Whatever remains now is pure profit and I will continue to add bit by bit every month when (I think) the price is right.

We’re sitting on a nice 141% in profit right now for the crypto portfolio. My BTC has gone up from RM38K to about RM62K since December. I’ve also consolidated my other crypto holdings and switched them out for ETH and staked them on Luno for now.

December 2023 Update

December update 🚀

Gross investment: RM14,441

Market value: RM38,372

Capital gain: +165.171%

Previous profit: RM50,000 (approximately)

End of the year update to my crypto. As mentioned in November, I sold about half of my BTC holdings.

Whatever remains now is pure profit and I will continue to add bit by bit every month when (I think) the price is right.

We’re sitting on a nice 165% in profit right now for the crypto portfolio. We’ll see where the ETFs and halving events bring us in the next few months!

October 2022

October update 🚀

Gross investment: RM22,379

Market value: RM35,827

Capital gain: +60.1%

Alright! As you may or may not have noticed, added about 2k worth of BTC in October. Didn’t pan out so well as BTC dipped again. But I’ll be continuously adding in monthly or bi-monthly for now.

I do believe we are almost at the bottom already and that crypto has established itself as an asset class over the years.

December 2021

December update 🚀

Gross investment: RM10,273

Market value: RM67,004

Capital gain: +552.23%

December 2020

RM111,907 per Bitcoin. I actually made a short term trade, selling at RM79K and buying again at RM77K. A little profit there to add to my crypto portfolio.

Gross Investment: RM13,808

Market Value: RM34,424

Capital Gain/Loss: +149.30%

Of course, a little remorse and regret at not having put a little more money in. But, seeing as it is within my target of 1-10% of my investment portfolio, I’m grateful.

September 2020

I’ll calculate my gross investment as RM3,808. It’s a rough estimate as this includes mining and unfortunately, I did not keep track of those properly back when I started in 2019.

Gross Investment: RM3,808

Market Value: RM5,528

Capital Gain/Loss: 45%

Bitcoin’s price today is at RM44,876 per bitcoin.

My total crypto portfolio stands at RM5,528.

It comprises of:

- 0.083395 BTC – RM3,742

- 1.200000 ETH – RM1,781

- 0.003866 BCH – RM4

Update 30 April 2020

As of 30 April 2020, my crypto portfolio worth RM3,808 consists of the following.

- Bitcoin – RM2,763

- Ethereum – RM1,039

- Bitcoin Cash – RM4

Update 30 April 2021

Damn a year has passed and looking at my 2020 numbers, I just cannot believe the run crypto is on. I’ve gone from RM3,808 to RM72,058.

December update 🚀

Gross investment: RM10,273

Market value: RM72,058

Capital gain: +601.43%

Let’s see where the next wave will take us.

Mining in the Past

Older readers of mine may also remember my crypto mining days.

My most recent update of cryptocurrencies was back in December 2018 when had about USD 288 (or approximately RM1,256). I have not made any additional investments since then.